Optimal monetary policy delegation in a small-open new Keynesian model with robust control

Abstract

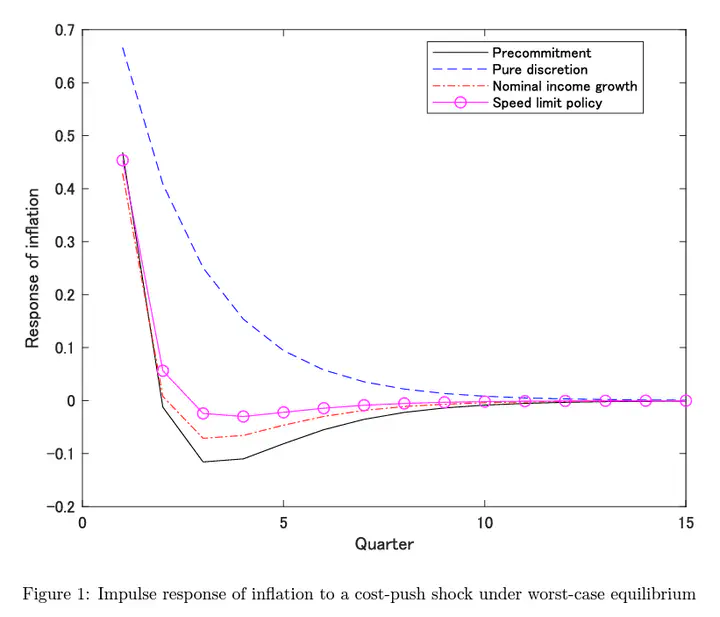

This study examines the optimal monetary policy delegation in a small-open new Keynesian model with model uncertainty. We show that under the worst-case equilibrium, nominal income growth targeting outperforms the considered alternative delegation regimes. We find that the response of the nominal exchange rate depends on the specifications of the delegated targeting regimes. Finally, introducing endogenous inflation persistence into the benchmark model does not affect our main findings.

Type

Publication

Economic Modelling