Does nominal wage stickiness affect fiscal multiplier in a two-agent new Keynesian model?

Abstract

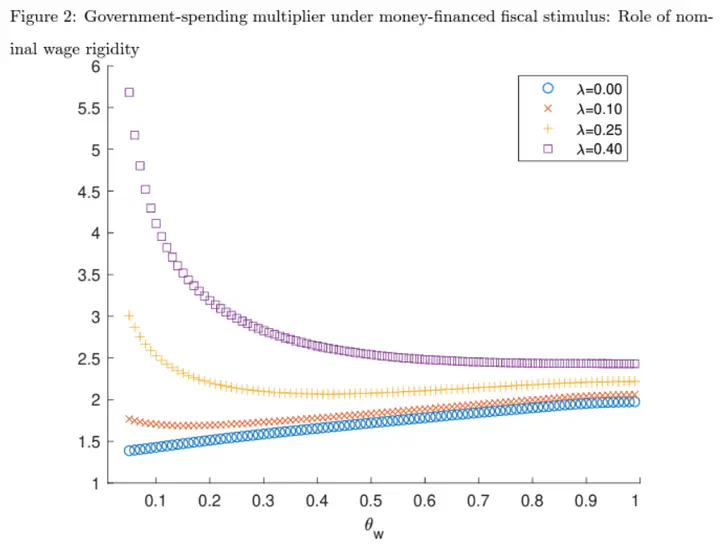

This study examines the effect of nominal wage stickiness on the fiscal multiplier in a two-agent new Keynesian model. We demonstrate that in the case of sticky nominal wages, an increased share of liquidity-constrained (LC) consumers decreases the moneyf inanced (MF) fiscal multiplier. Our model shows that the fiscal multiplier under an MF regime outperforms that under a debt-financed (DF) regime. Under empirically plausible calibration, the benchmark model indicates that the MF government-spending multiplier is 1.5–3.0, whereas the DF multiplier is 0.8–1.5. We also find that an increased share of LC consumers magnifies the tax-cut multiplier in the cases of MF and DF regimes despite nominal wage stickiness.

Type

Publication

The B.E. Journal of Macroeconomics